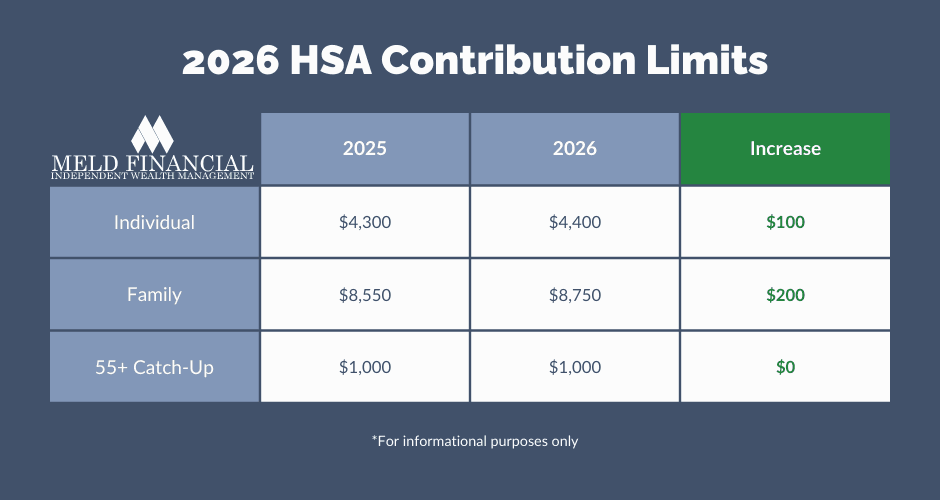

Health Savings Accounts (HSAs) are set for a major overhaul. Millions of Americans could benefit from more flexible options under the One Big Beautiful Bill. The IRS has released guidance detailing the changes, which take effect starting next year.

HSAs allow people to save money pre-tax for medical expenses. They also grow tax-free and can be used without penalties for eligible costs, such as copays, deductibles, and coinsurance. These accounts are now becoming even more versatile. The new rules aim to make healthcare spending simpler and more manageable.

1. Telehealth Coverage Becomes Permanent

Telehealth and remote care services are now fully integrated. People can use these services before reaching their HDHP deductible and still contribute to an HSA. This change applies to plan years starting January 1, 2025. Experts say it will encourage virtual doctor visits and reduce delays in care. Patients can now manage minor health issues, prescriptions, and follow-ups without financial penalties.

2. Bronze and Catastrophic Plans Now HSA-Eligible

Previously, only certain HDHPs allowed HSA contributions. Starting January 1, 2026, Bronze and Catastrophic plans will qualify. Millions of Americans will now have access to tax-free healthcare savings without switching insurance plans. This change could especially help younger adults or those with lower-cost plans. It gives families and individuals more financial freedom and better options for planning healthcare costs.

3. Direct Primary Care Services Included

Direct Primary Care (DPC) arrangements were once a barrier to HSA eligibility. Now, individuals in qualifying DPC programs can contribute to their HSAs. HSA funds can cover monthly DPC fees up to $150, adjusted yearly for inflation. Experts note this encourages personalized care and easier access to doctors. Patients can combine HDHP coverage with direct, subscription-style care while still enjoying tax benefits.

These updates make HSAs more flexible and easier to use. Americans can now pair modern healthcare options like telehealth and DPC services with tax-free savings. The changes may help millions save money on medical expenses, plan for long-term healthcare, and avoid unexpected costs. Financial advisors call it a game-changer for managing health expenses while building wealth over time.