The U.S. economy delivered a stronger-than-expected performance in the third quarter, expanding at an annualized pace of 4.3 percent, according to fresh figures released Tuesday by the U.S. Commerce Department.

The data eased concerns about the health of the world’s largest economy, particularly after recent indicators pointed to softness in the labor market. It also arrived amid fading anxiety over President Donald Trump’s trade policies and a surge of capital spending by major technology firms racing to build artificial intelligence infrastructure.

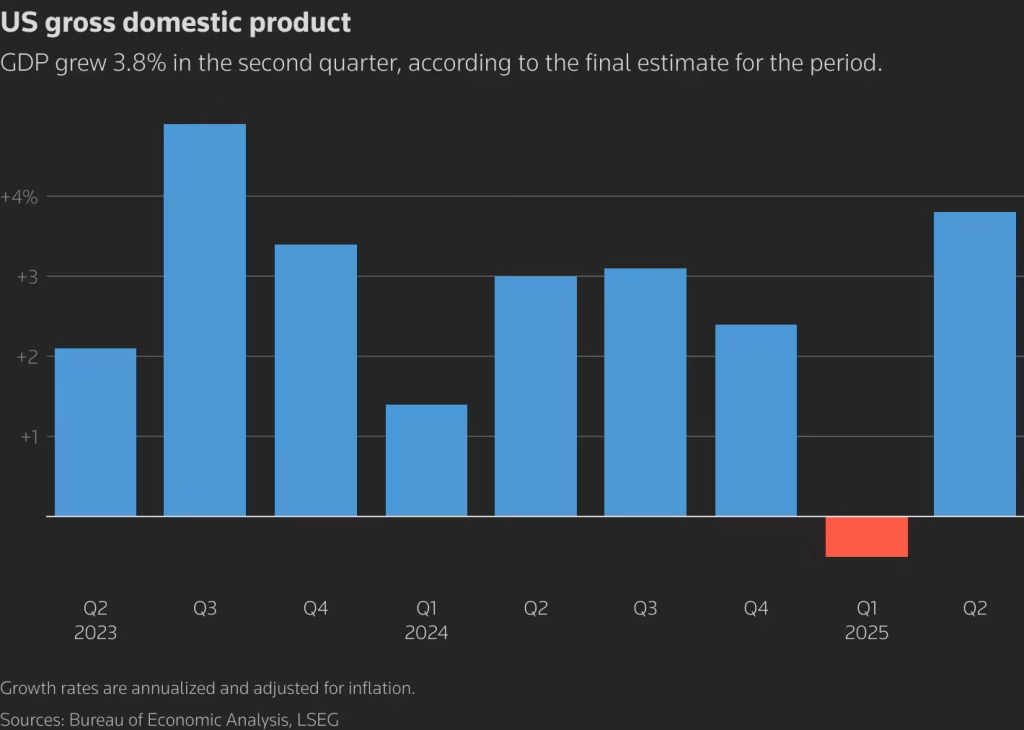

The gross domestic product report—postponed nearly two months due to a federal government shutdown—showed that economic growth was fueled by stronger consumer spending, rising exports, and increased government outlays. Those gains were partially offset by a decline in private investment, according to the Bureau of Economic Analysis.

This preliminary estimate, which will be revised in early 2026, represents the fastest pace of U.S. growth in roughly two years. Economists surveyed by MarketWatch and Trading Economics had forecast a more modest 3.2 percent increase.

Inflation Accelerates Alongside Growth

The report also revealed that inflation pressures intensified. The price index for domestic purchases climbed 3.4 percent in the third quarter, up sharply from the 2.0 percent pace recorded in the previous quarter.

The combination of faster growth and hotter inflation surprised financial markets and could complicate upcoming decisions by the Federal Reserve, which has recently been focused on stabilizing employment.

Despite inflation remaining above the Fed’s 2 percent target, policymakers have emphasized the cooling labor market as the more pressing issue. That concern led the central bank to cut interest rates at its last three meetings.

Markets Reassess Rate Cut Expectations

Following the release of the GDP data, U.S. stock futures moved lower, reflecting reduced expectations for another rate cut at the Fed’s next meeting.

“With growth numbers this strong, the Fed has more justification to pause,” said Sam Stovall of CFRA Research. “It increases the likelihood that policymakers stay on hold at the January meeting.”

Fed Chair Jerome Powell and other officials have acknowledged that inflation remains elevated but continue to signal concern about job market weakness.

According to the central bank’s latest projections, the Fed now expects median GDP growth of 2.3 percent in 2026, an upward revision from its 2025 outlook of 1.7 percent.

Trade Stability and AI Spending Lift Outlook

The latest economic snapshot marks a notable improvement from early 2025, when uncertainty surrounding Trump’s aggressive tariff proposals weighed heavily on business confidence.

By the second half of the year, however, the administration reached trade agreements with China and other major economies, avoiding the implementation of the most severe tariffs and calming global markets.

At the same time, a boom in artificial intelligence investment—led by companies such as OpenAI and Google—has continued to pour fuel into the U.S. economy, helping keep equity markets near record highs.

Political Uncertainty Still Looms

In a December 18 outlook, S&P Global Ratings said AI-driven investment should support economic growth but warned that political instability could temper those gains.

“While uncertainty around U.S. trade policy has diminished, broader policy volatility has not,” the firm noted.

S&P added that although tariff rates may remain relatively stable in 2026, ongoing uncertainty around legislation, investment rules, geopolitical tensions, and military actions could weigh on corporate spending and discretionary consumer activity.